For additional checking before placing forex trading orders, candlesticks for forex reversal can be used to confirm the right point to enter a forex trade. Since two indicators are used, it is safer to purchase or sell Forex. 200 / 250 period: The same holds true for the 200 moving average. The 200 Ema indicator helps detect the trend, and the stochastic indicator is useful for measuring how strong the trend is. The EMA gives more weight to the most recent price action which means that when price. Traders will find that they face the problem that the trend is powerful, yet the stochastic indicator gives an inaccurate signal. The stochastic indicator oscillates between extreme values. This strategy is ineffective when there are no trends the market moves sideways since many false signals are generated. Disadvantages of the stochastic, 200 ema indicator, scalping strategy Level and targets are 76.4% and 100% Fib.

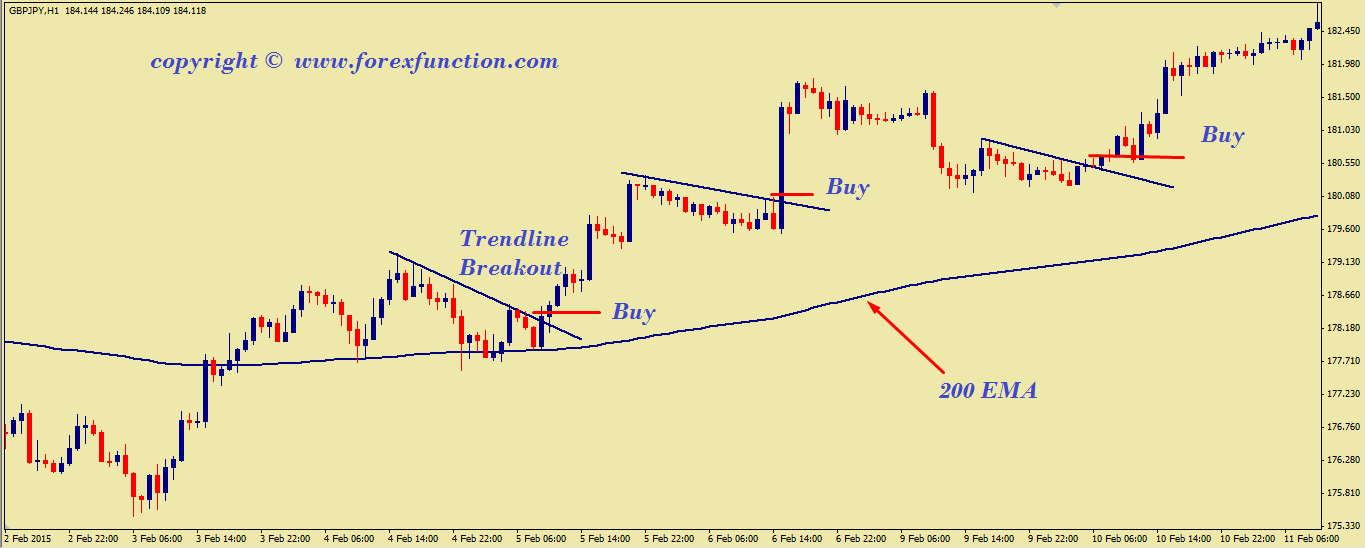

On 5 minute chart, the price is above EMA200, and stochastic is below 20. If both these conditions are satisfied, the trader should immediately place his order for selling when the candlestick closes. He should also confirm that the stochastic indicator value checks whether it has exceeded 80 and is now reducing. Users of the MT4 forex trading platform will find that the stochastic indicators are the default setting.Īfter noticing a downtrend in the market, the trader should sell with prices below the 200 ema indicator level. The 200 ema and stochastic are the main Forex indicators used. The time frames can vary and should be preferably more than 5 minutes. This scalping strategy can be used for any currency pair. SELL order will be generated if the main trend is a downtrend moving below the 200 EMA value, while the stochastic indicator is above 80. There were 142 successful trades with 198 unprofitable trades with the Moving Average Trader profit being 175.92 and typical loss being 102.76. BUY order will be generated if the main trend is uptrend moving above the 200 EMA value, while the stochastic indicator is below 20. Using the exact same 5 stop, our trading system went from losing practically 10,000 to acquiring 4635.26 over the exact same 10 years of information The performance is now a favorable 9.27. While the 200 EMA moving average represents an indicator that shows the following, the stochastic indicator determines the moment to enter into a trade. Using 200 EMA and stochastic indicators for forex trading – Stochastic pullback strategyĢ00 EMA and stochastic indicator trading strategy is a trend trading strategy where orders are generated after a pullback.

On the other hand, if the stochastic indicator decreases below 20, the forex market is oversold, and prices will likely increase in the future. For this indicator, when the stochastic levels exceed 80, too many traders have invested, and prices are likely to decrease. The stochastic indicator is used to determine oversold or overbought market conditions.

If the price is below 200 ema, the forex trend is down, and if it is above 200 ema, it is considered an upward trend. For their scalping strategy, foreign exchange (Forex) traders use the 200 exponential moving average (EMA) and the stochastic indicator.

0 kommentar(er)

0 kommentar(er)